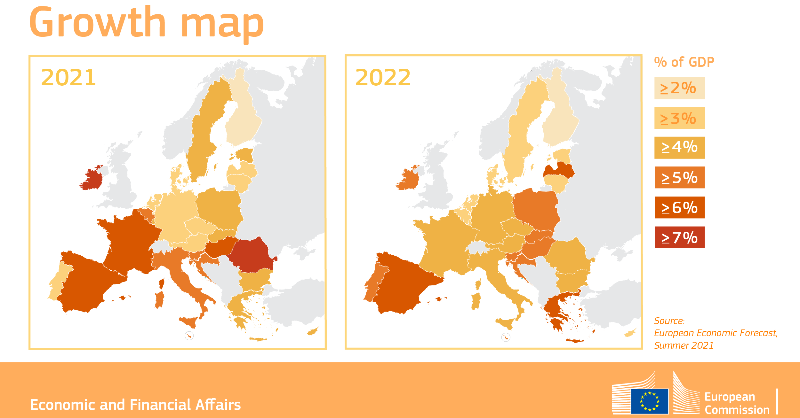

Countries seeking economic recovery should closely monitor EU countries as the European economy is making a solid comeback.

Recently the European Commission announced that the European economy is forecast to rebound faster than previously expected.

Private consumption and investment are expected to be the main drivers of growth, supported by employment that is expected to move in tandem with economic activity.

As the economy recovers, ensuring the effective collection of VAT tax revenue is vital to fund quality public services and it is a precondition for a fair sharing of the tax burden between taxpayers.

We remind our followers that most Revenue Authorities from the EU and non-EU member states (Slovakia, Poland, the Czech Republic, Bulgaria, Georgia, Sweden, Hungary, Croatia, Portugal, Macedonia, Armenia and others) utilize the new generation Tax collection technology like Virtual Fiscal Device Management System (VFDMS). It helps improving revenue collection and track digital sales and apply VAT.

Countries seeking economic recovery should closely monitor EU countries.

For instance, recently, African Eye Report featured our new generation tax collection technology, Virtual Fiscal Device Management System (#VFDMS) as a tool for rebooting Africa’s Economy.

Zanzibar says studies have shown that monthly revenue collections will rise by about 20 percent when the semi-autonomous Indian Ocean archipelago ditches manual tax collecting for electronic Virtual Fiscal Device Management System VFDMS means

VFDMS addresses challenges related to:

- Poor VAT collection performance

- Low rates of business compliance (informal economy)

- Ineffective staff

- High Administrative and Compliance costs of VAT

- Low reputation of Revenue authority and corresponding lack of trust

- Difficulties tracking digital sales and applying VAT

- Data security

Interested in this story?

Contact us to discuss any inquiries you might have about this topic.

Thank you!

We will contact you soon!